The tax perks of owing an investment property have been in the news a lot recently, even as the property market shows signs of cooling in many parts of the country. If you’re thinking of managing your own investment property, what do you need to know to keep your taxes in order?

The Basics

When you own a property and rent it out, the rental income that you earn is taxable. However, you can then deduct most expenses that you incur in generating that income. Broadly speaking, when your expenses exceed your income (that is, you make a loss), your property is negatively geared. When your income exceeds your expenses (you make a profit), your property is described as positively geared.

Recent statistics indicate that over 1.8 million Australians own an investment property, about two-thirds of them negatively geared.

Deductions

Of the various items of expenditure that you might incur in running a rental property, probably the most significant is the amount you pay on your mortgage. The interest element of your mortgage repayment is deductible for tax purposes. Therefore, by gearing your property to the maximum level possible under the rules allowed by your bank, you can also maximise the interest charges you can claim as a tax deduction.

In a common negative gearing scenario, the amount that you earn in rent is less than the amount you spend on your rental property, including mortgage interest plus all the other expenses for which you can claim a tax deduction, such as land rates, water rates, estate agent fees, advertising for tenants, pest control, insurance, gardening and lawn mowing, depreciation on the cost of the building, repair and maintenance costs, body corporate fees and cleaning fees.

That means that you’ve made a loss on your rental property and tax law allows you to offset that loss against your other income in the year. When you lodge your tax return, the resulting loss will often result in a significant refund of tax.

Apart from bank interest, there are many other deductions you may be able to claim, including:

- Advertising for tenants, including costs passed on by letting agents.

- Cleaning at the end of a tenancy (including removal of rubbish).

- Estate and letting agents (including management fees).

- Gardening and lawn mowing (including felling or pruning trees).

- Secretary and bookkeeping fees associated with the collection of rent and payment of property expenses.

- Bank charges on the account used to receive rent and pay expenses.

- Council rates and land tax.

- Insurance (building, contents or public liability).

- Credit checks.

- Pest control.

- Bank or solicitor fees for keeping title documents safe.

- Taxation advice relating to the property

- Legal expenses to eject a tenant for non-payment of rent.

- Hiring a debt collector to collect rent arrears.

- Getting new keys cut.

- Servicing items such as hot water heaters, smoke alarms, air-conditioning systems and garage door mechanisms.

- Water supply charges (to the extent that they aren’t paid by the tenant).

- Quantity surveyor.

- Security patrols.

- Security system monitoring and maintenance.

- Depreciation on plant, equipment, fixtures and fittings (subject to certain restrictions)

- Depreciation on the building (or capital works depreciation as it is sometimes called)

If you pay expenses this tax year for a service that carries on into the next tax year (for example, a yearly insurance policy), you can claim for the whole cost this year.

Capital Gains Tax on Investment Properties

When you sell the property, you are subject to capital gains tax (CGT) on the profit. In very simple terms, the profit is the difference between your sale proceeds (less costs of sale such as legal and estate agency fees) and what you paid for it (including stamp duty and other purchase costs such as legal fees). CGT is levied at your marginal tax rate (between 19% and 45%) on the resulting profit. But if you own the property for more than 12 months, you become eligible for the 50% CGT discount. This basically halves the amount subject to tax, and is equivalent to halving the rate of tax you pay on the full gain.

Avoid trouble with the tax office!

Generally, repairs and maintenance costs are allowable for tax but be very careful if you’re claiming costs in the first 12 months of ownership. The ATO often seeks to deny instant deductions in this scenario on the basis that such “repairs” are often of a capital nature, being repairs done to rectify defects that existed when the property was acquired.

To claim deductions, you need to let the property on a commercial basis. If the property is being let rent free (or at a non-commercial rate) to, say, friends or family, the amount of deductions you can claim will be limited to the amount of rental income you earned.

Always keep detailed records of all income and expenses. If the ATO reviews or audits your tax return, you will need your supporting documentation to justify your deduction claims. Normally you need to keep records for five years from the date you lodged your tax return but for capital gains tax purposes, you should keep purchase and sale documentation (with details of any capital improvements) for at least five years from the date of lodging the return showing the disposal of the property. Given that you may retain ownership of the property for a long period, that means that your purchase documentation in particular will need to be stored safely for many years.

Get Help

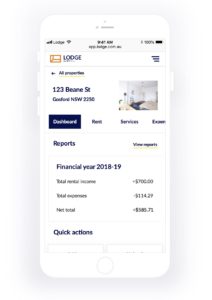

Keeping tabs on your taxes can be tricky so it pays to get help. As well as tapping in to the tax expertise of H&R Block, consider the newly launched Lodge by BPAY Group. This is an online platform that gives independent landlords the tools and insights to make managing their property easy and empower them to unlock the potential of their biggest asset. Lodge features auto-rent collection, recording expenses, storing documents and simplifies tax by generating tax reports that can be sent directly to your accountant in an easy to use online platform. By seamlessly connecting the fragmented processes involved in managing investment properties, Lodge simplifies property management for landlords.

Mark Chapman is the Director of Tax Communications at H&R Block.